Crude Oil, ‘Crap Stocks’, & Credit Soar Amid Hedge Fund Carnage

Carnage Ahead Of “Largest OpEx In History”

December hit and Biden approval collapsed

…we heard the ‘c-word’ a lot.

Where to start…

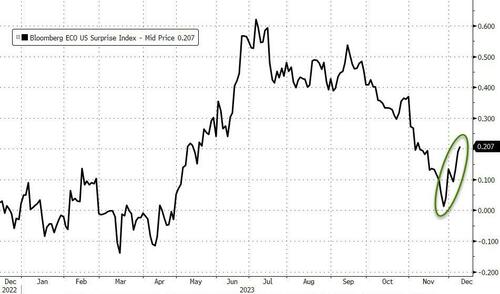

- US Macro is surging

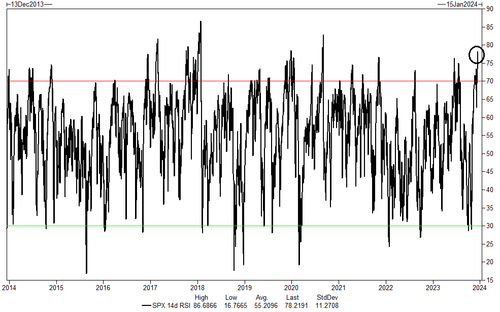

- The S&P is incredibly overbought

- Hedge Fund bloodbath accelerates

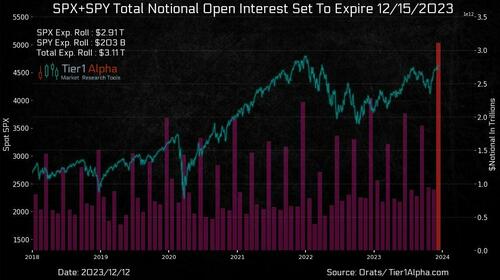

- Massive (Record) OpEx [Friday]

- 160bps of rate-cuts now priced in for 2024

- Financial Conditions “loosest” since June 2022

The rest is more of the same – dollar puking, bonds soaring (yields plunging), gold and bitcoin higher, and oil spiking.

US Macro data continues to ‘beat’ (paging six-rate-cuts in the dot-plot) in direct opposition to Powell’s pivot to uber-dove…

Source: Bloomberg

…which smashed Financial Conditions to their loosest since June 2022…

Source: Bloomberg

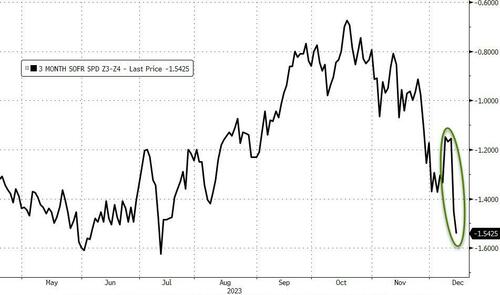

And the market saw its inch and took a mile, now daring The Fed with 160bps of cuts priced-in for 2024…

Source: Bloomberg

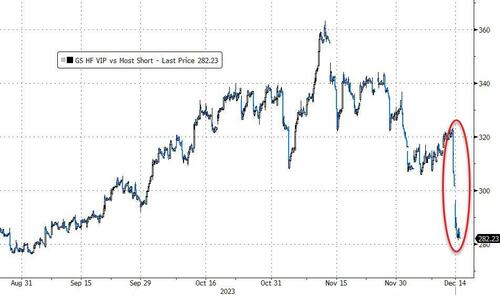

Hedgies have been humbled with a massive 12% plunge in the last two days as their favorite longs have underperformed and their biggest shorts have been squeezed massively higher…

Source: Bloomberg

The biggest 2-day drop since Jan 2021…

Source: Bloomberg

The dash for trash is evident as MAG7 stocks become a ‘source of funds’ to chase ‘crap’ stocks…

Source: Bloomberg

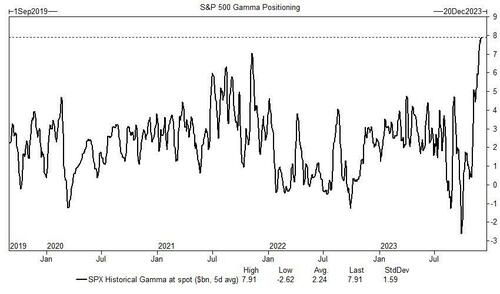

And all of this is happening with gamma at record highs…

And [Friday] is on course to become the largest OpEx in history for $SPX/ $SPY linked contracts, with a staggering $3.1 trillion in notional Open Interest scheduled to expire this Friday.

SPX is nearing the most overbought level (RSI >70) in well over a decade…

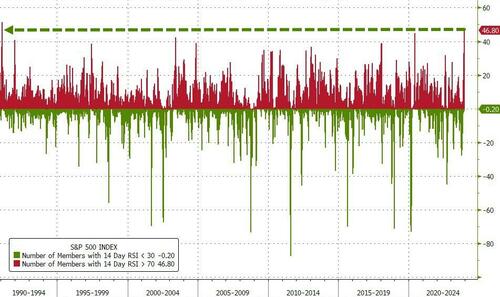

47% of the S&P 500 members are overbought after [] surge – the most since Feb 1991…

Source: Bloomberg

Small Caps are up – wait for it – over 7% since 1400ET yesterday when the ‘Powell Pivot’ hit. The rest of the majors are up around 1-2%…

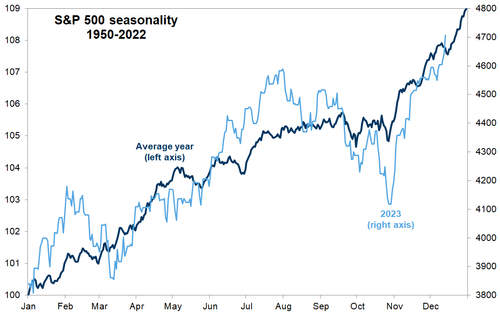

But hey… it was easy really…

And if The Fed really wants to stomp on the tightening throat of real yields then S&P 500 P/Es are going back to the moon…

Source: Bloomberg

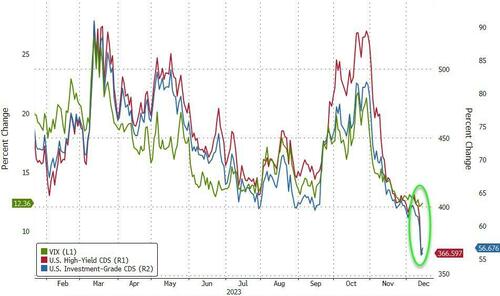

VIX was steady ahead of OpEx (with a 12 handle) as credit spreads (IG and HY) crashed)…

Source: Bloomberg

Bonds extended their price gains and yield declines with the short-end outperforming (2Y -34bps, 30Y -27bps this week)…

Source: Bloomberg

…with 2s thru 7s now all lower on the year…

Source: Bloomberg

The 10Y Yield tumbled back below 4.00% (and 30Y dropped to 4.02%), its lowest since July…

Source: Bloomberg

The dollar extended [] plunge for the biggest 2-day drop since July…

Source: Bloomberg

Bitcoin and Gold extended gains as real yields fell today…

Source: Bloomberg

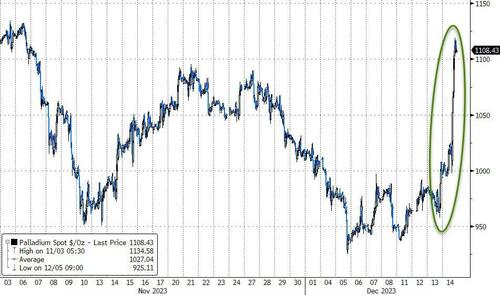

Palladium also exploded higher, up almost 12% (the biggest daily jump since March 2020)…

Source: Bloomberg

Oil extended its rebound with WTI back above $72…

…that is not at all what The Fed will want to see if it is really going to stick to its plan of slashing rates.

Finally, are we here?

…and how long before Powell resigns?

In the first half of the year we had recession fears which priced in an increasing number of rate cuts for next year (and saw Biden’s approval decline)… then Aug-Oct we saw the economy appear to improve and rate-cuts were removed optimistically, but amid that optimism in the market, Biden’s approval rating continued to decline…

Then December hit and Biden approval collapsed… triggering markets to suddenly price in a massive rate-cut shift next year

Does make one wonder.

_________

RELATED

Now It All Makes Sense

Economic Angst In The Heartland

*********

(TLB) published this article from ZeroHedge as compiled and written by Tyler Durden

Header featured image (edited) credit: C ring of fire/org. ZH article

Emphsis and editing by (TLB)

••••

![]()

••••

Stay tuned to …

![]()

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Leave a Reply