Fed Taking “Cautious Approach” Before Plunge Into Uncertainty

FOMC Minutes from Meeting Show Fear

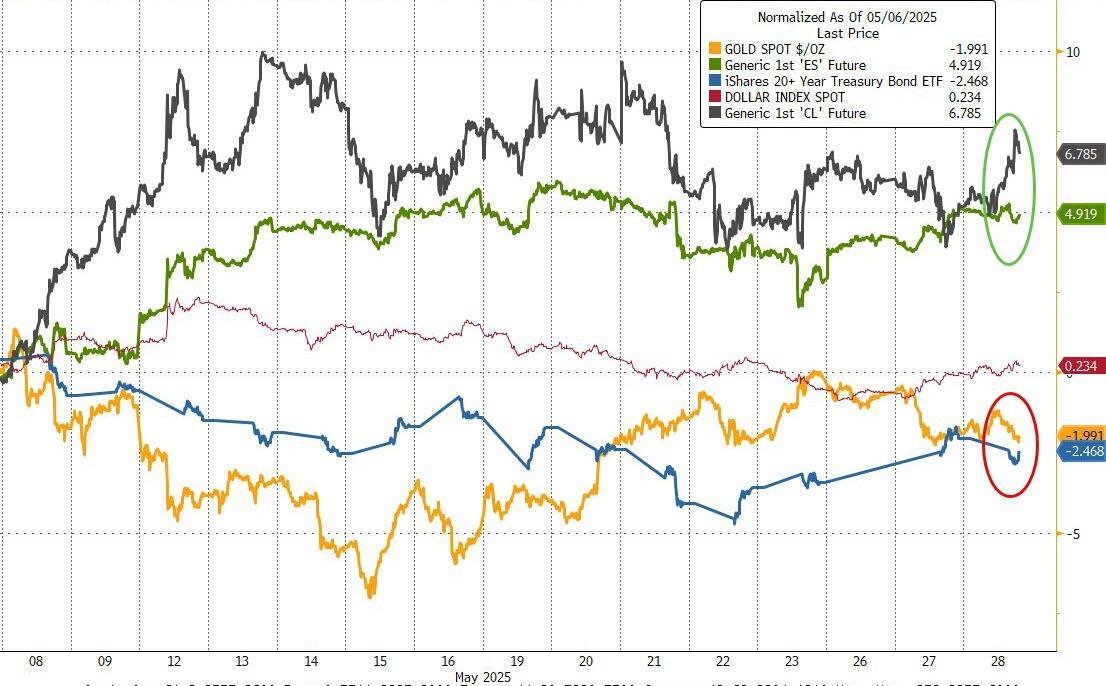

(ZH) Since the last FOMC meeting, on May 7th, the market has been mixed with stocks and crude oil rallying strongly while gold and bonds have been sold (the dollar is basically unchanged)…

Source: Bloomberg

…but bitcoin has soared over 15% since the last FOMC meeting…

Source: Bloomberg

Hard data continues to be steady and growing while ‘soft’ survey data has surged in the three weeks since the last Fed meeting…

Source: Bloomberg

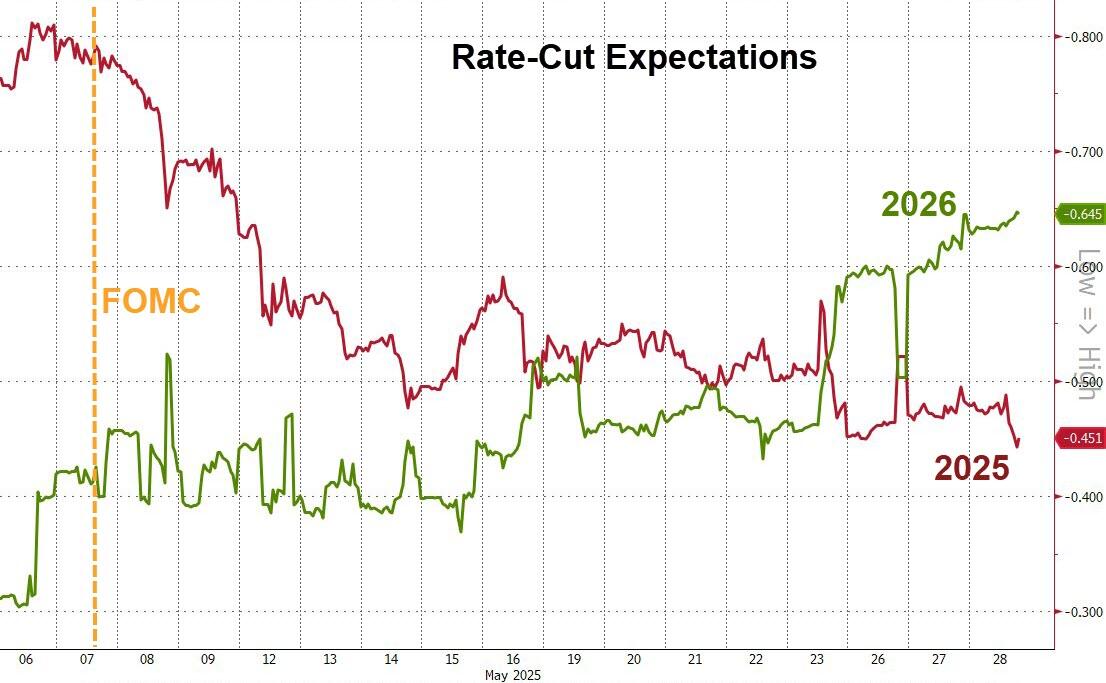

Which has pushed rate-cut expectations lower overall (with cuts shifting from 2025 to 2026)…

Source: Bloomberg

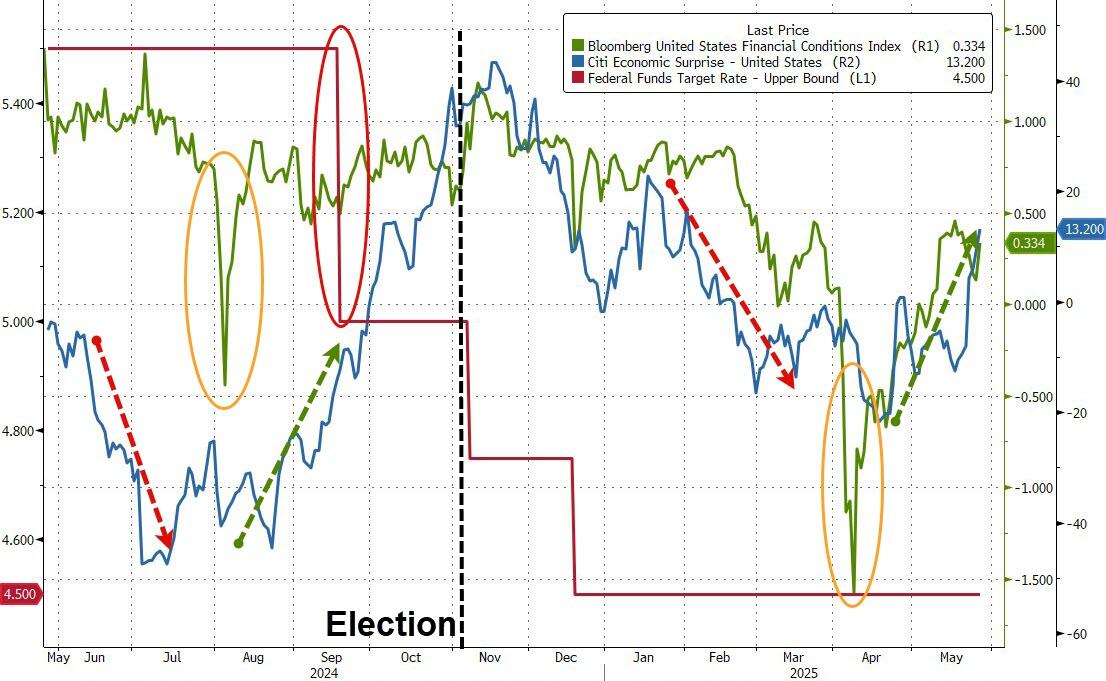

As a reminder, in spite of the exact same macro background of a dramatic tightening in financial conditions (orange oval) and weakness morphing into strength for US Macro data (red and green arrow), Powell and his pals decided a 50bps rate-cut (red oval) was not necessary this time… we wonder why (black line)?

Source: Bloomberg

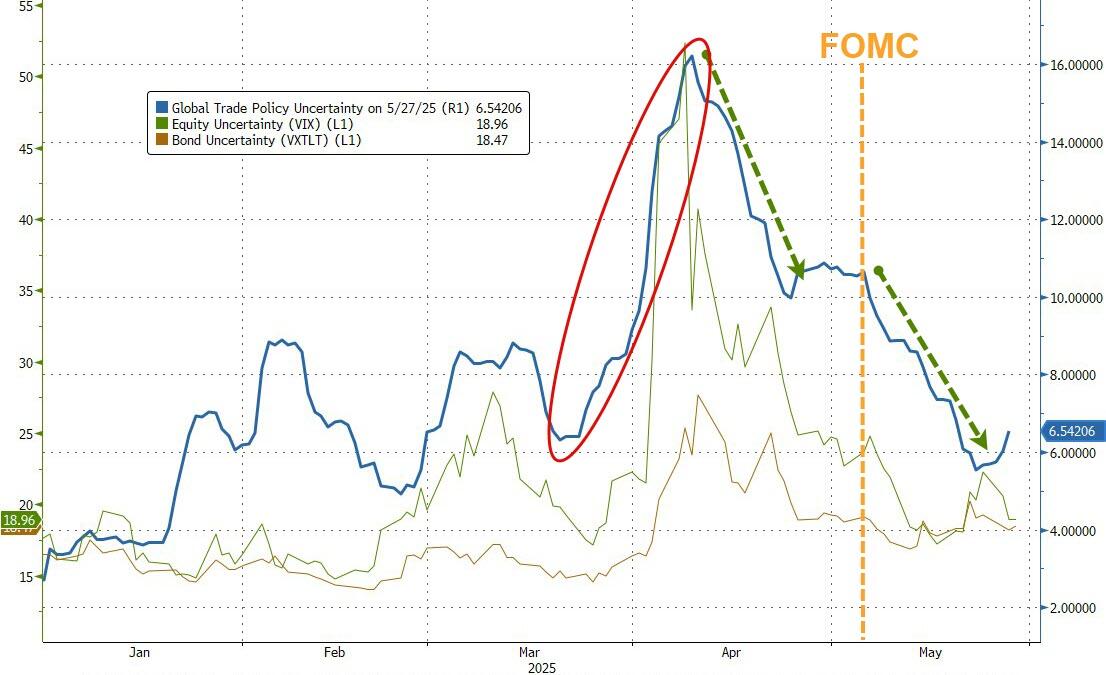

Finally, before we see what they said (or want us to know), we noted that “uncertainty” was a key word used by Powell (during the statement and the press conference). Overall ‘Uncertainty’ had fallen into the meeting and since then it has plunged to its lowest since February (before Liberation Day)…

Source: Bloomberg

As we detailed in the preview, these minutes of the meeting are an account of information that was available to the Fed at the time of the meeting on 7th May 2025, therefore it will not incorporate the recent de-escalation on trade with China.

So, What Did They Want Us To Know?

Here are the key headlines from the Minutes:

Participants agreed that uncertainty about the economic outlook had increased further, making it appropriate to take a cautious approach until the net economic effects of the array of changes to government policies become clearer.

Uncertainty is key:

Significant uncertainties also surrounded changes in fiscal, regulatory, and immigration policies and their economic effects.

Taken together, participants saw the uncertainty about their economic outlooks as unusually elevated.

On inflation, they are split:

Some participants assessed that tariffs on intermediate goods could contribute to a more persistent increase in inflation. A few participants noted that supply chain disruptions caused by tariffs also could have persistent effects on inflation, reminiscent of such effects during the pandemic.

Several participants highlighted factors that might help mitigate the magnitude and persistence of potential increases in inflation, such as reductions of tariff increases from ongoing trade negotiations, less tolerance for price increases by households, a weakening of the economy, reduced housing inflation pressures from lower immigration, or a desire by some firms to increase market share rather than raise prices on items not affected by tariffs.

Growth fears:

The labor market was expected to weaken substantially, with the unemployment rate forecast moving above the staff’s estimate of its natural rate by the end of this year and remaining above the natural rate through 2027.

…and finally, this fearmongering:

Some participants commented on a change from the typical pattern of correlations across asset prices during the first half of April, with longer-term Treasury yields rising and the dollar depreciating despite the decline in the prices of equities and other risky assets.

These participants noted that a durable shift in such correlations or a diminution of the perceived safe-haven status of U.S. assets could have long-lasting implications for the economy.

[CLICK HERE to read the full Minutes release]

_________

Header featured image (edited) ccredit: Org. post content tease. Emphasis added by (TLB)

••••

••••

Stay tuned…

![]()

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Leave a Reply