First Dollar General, Now Dollar Tree Shares Plunge

Discount Retailers Warn that Customers have Less Money to Spend

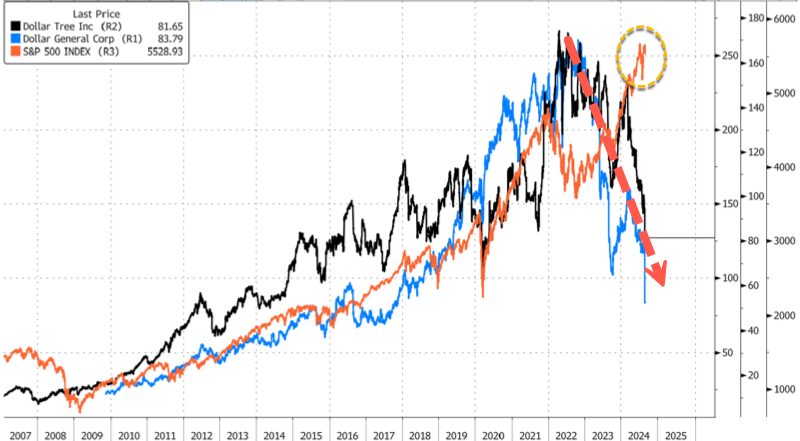

Shares of Dollar Tree plunged nearly 12% in premarket trading in New York after the discount retailer, which operates thousands of stores nationwide, posted fiscal second-quarter earnings that fell short of Wall Street expectations. The company also slashed its full-year outlook, pointing to mounting financial pressures on middle-income and higher-income customers. This comes less than a week after major rival Dollar General reported a “financially constrained core customer” that sent shares crashing the most on record.

Dollar Tree reported this morning that the macroeconomic environment is pressuring its middle—and higher-income consumers. Traffic increased during the quarter, but the average ticket size decreased. It said second-quarter comparable sales and adjusted earnings per share missed Wall Street’s expectations.

Here’s a snapshot of second-quarter earnings (courtesy of Bloomberg):

- Adjusted EPS 67c vs. 91c y/y, estimate $1.05

- EPS 62c vs. 91c y/y

Enterprise comparable sales +0.7% vs. +6.9% y/y, estimate +1.45%

- Family Dollar comparable sales -0.1%, estimate -0.21%

- Dollar Tree Segment comparable sales +1.3% vs. +7.8% y/y, estimate +2.89%

Net sales $7.37 billion, +0.7% y/y

- Dollar Tree net sales $4.07 billion, +5% y/y, estimate $4.16 billion

- Family Dollar net sales $3.31 billion, -4% y/y, estimate $3.35 billion

Gross profit margin 30% vs. 29.2% y/y, estimate 29.9%

- Dollar Tree gross margin 34.2% vs. 33.4% y/y, estimate 34.1%

- Family Dollar gross margin 24.9%, estimate 24.6%

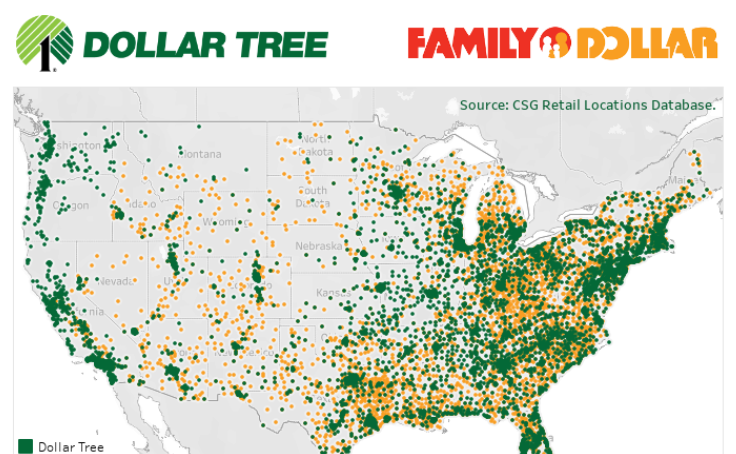

Total location count 16,388, -0.5% y/y, estimate 16,374

- Dollar Tree Locations 8,627, +5.5% y/y, estimate 8,294

- Family Dollar locations 7,761, -6.5% y/y, estimate 8,071

With nearly 16,400 stores nationwide, the discount retailer now expects its full-year consolidated net sales outlook between $30.6 billion and $30.9 billion versus the previous forecast of $31 billion to $32 billion.

- Sees net sales of $30.6 billion to $30.9 billion, saw $31.0 billion to $32.0 billion

- Sees adjusted EPS $5.20 to $5.60, estimate $6.57 (Bloomberg Consensus)

Chief Financial Officer Jeff Davis wrote in a statement that the “increasing effect of macro pressures on the purchasing behavior of Dollar Tree’s middle- and higher-income customers” was the main driver in slashing its full-year sales forecast.

Here’s Goldman’s Eric Mihelc and Scott Feiler’s take on Dollar Tree earnings:

“DLTR -13%…Low bar post DG results but the 20% guidance cut is worse than expected (a cut was expected but most we had heard from were not this low). Also, they spoke to weakness spreading to their middle and higher income (it’s all relative) customers. Details: 2Q EPS of $0.97 vs Consensus $1.04, with revenues 160 bps light. Comps of +0.7% vs Consensus +1.6%. Dollar Tree brand drove the comp miss. SG&A also missed by 200 bps. They spoke to the increasing effect of macro pressures on the purchasing behavior of Dollar Tree’s middle- and higher-income customers. Guides 3Q EOS light at $1.10 (mid) vs Consensus $1.32 and revenues 1% light. Lowers 2024 EPS to $5.40 (mid) vs prior $6.75, a 20% cut, on a revenue cut as well.”

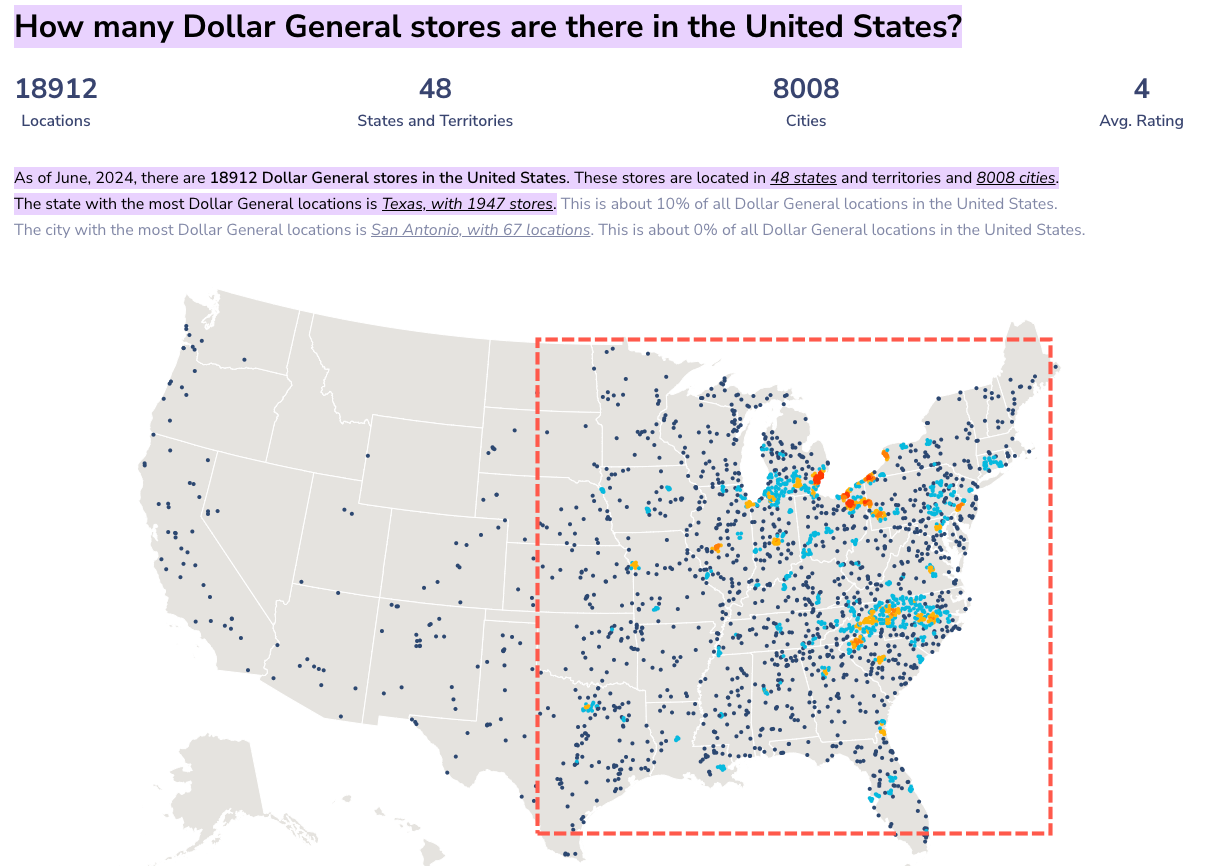

What’s critical to note for the political strategist: Dollar Tree & Family Dollar and Dollar General stores are mostly concentrated in the eastern half of the US. Mangment’s gloom about its core customer base should serve as a proxy for consumer sentiment for mid/low-tier consumers. In other words, there is a lot of gloom and doom among working-poor Americans in critical swing states.

Last week, Dollar General shares crashed the most on record after management warned that core customers “feel financially constrained.”

*DOLLAR GENERAL SINKS 26% IN RECORD DROP ON SALES OUTLOOK CUT https://t.co/wZXRITf098

— zerohedge (@zerohedge) August 29, 2024

DG’s stores are primarily based in the eastern half of the US. Again, this should serve as a proxy for consumer sentiment.

In markets, shares of Dollar Tree in New York plunged 12%.

Is the slide in Dollar Tree and Dollar General shares a signal for broader main equity indexes?

Meanwhile, both discount retailers are facing heightened competition from Aldi and Walmart as corporate America fights over the market share of the middle class that is imploding under Bidenomics.

*********

(TLB) published this article from ZeroHedge as posted by Tyler Durden

Header featured image (edited) credit: org. ZH article content

Emphasis added by (TLB)

••••

![]()

••••

Stay tuned to …

![]()

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Leave a Reply