Fed Has Credibility Crisis & Powell Knows It

Rates To 4% “Come Hell Or High Water”

Post by Tyler Durden | Written by Mike Shedlock via MishTalk.com

…some interesting statements by former Fed Vice Chair Richard Clarida and his ducking of questions on the Fed’s role in this mess.

Image of Richard Clarida from video below

Credibility Problem and Disconnect

2/3

This perfectly illustrates both the disconnect and huge credibility problem the Fed has.

As the chart below shows, 4% is already priced in. This is not a bold “hell or high water call.” It should be a milktoast statement of the obvious. But it does not seem to be. pic.twitter.com/h16XwjvA4x

— Jim Bianco biancoresearch.eth (@biancoresearch) September 9, 2022

Richard Clarida on Squawk Box

Q: Is the fed data dependent or are they going to 4% come hell or high water.

Clarida Response

- I think they are going to 4% hell or high water if I had to out it into two boxes.

- Inflation is way too high. Inflation was way too high last year.

- Until, inflation comes down, the Fed is really a single mandate central bank.

- They are data dependent but the inflation data is too high. So I think they are going to at least 4%.

- I agree it’s not a great place to be in. If it was just Putin, you are right. But unfortunately the economy is out of balance now.

Clarida ducked hard questions on the Fed’s role in this mess while admitting he got the inflation picture wrong.

Clarida also supported fiscal stimulus, the last round of which was the big problem.

No one at the Fed saw this coming and they ridiculously kept QE going all the way to March of 2022.

So yes, the Fed has an enormous credibility problem and Powell understands that.

As a direct consequence, the Fed is highly likely to make a mistake in the opposite direction.

Meanwhile, the big spotlight appears to be on jobs and the unemployment rate.

Strong Job Gains? Don’t Count On It!

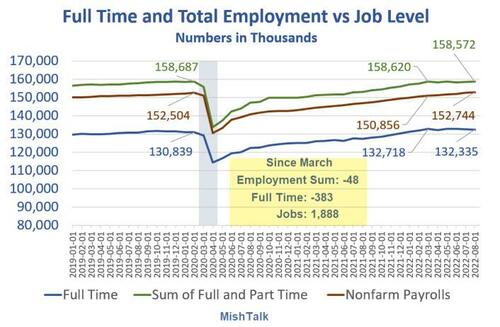

It’s Increasingly Likely That Alleged Job Strength is a Mirage of Part Time Second Jobs

If Unemployment Levels Remain Low, How Far Can the Stock Market Decline?

Here’s the question of the day: If Unemployment Levels Remain Low, How Far Can the Stock Market Decline?

The answer isn’t pretty given The Fed is Openly Cheering the Stock Market Plunge Following Jackson Hole

* * *

Please Subscribe to MishTalk Email Alerts.

*********

(TLB) published this article as posted by Tyler Durden and written by Mike Shedlock via MishTalk.com

Header featured image (edited) credit: Richard Clarida/Twitter grab

Emphasis added by (TLB) editors

••••

![]()

••••

Stay tuned to …

![]()

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Leave a Reply