The Irony Of Moody’s Downgrade Of U.S. Credit

Honestly, I don’t know whether to laugh at the fact that this didn’t happen a decade ago or at the fact that they waited until now. ~QTR

QUOTH THE RAVEN writes on Substack…

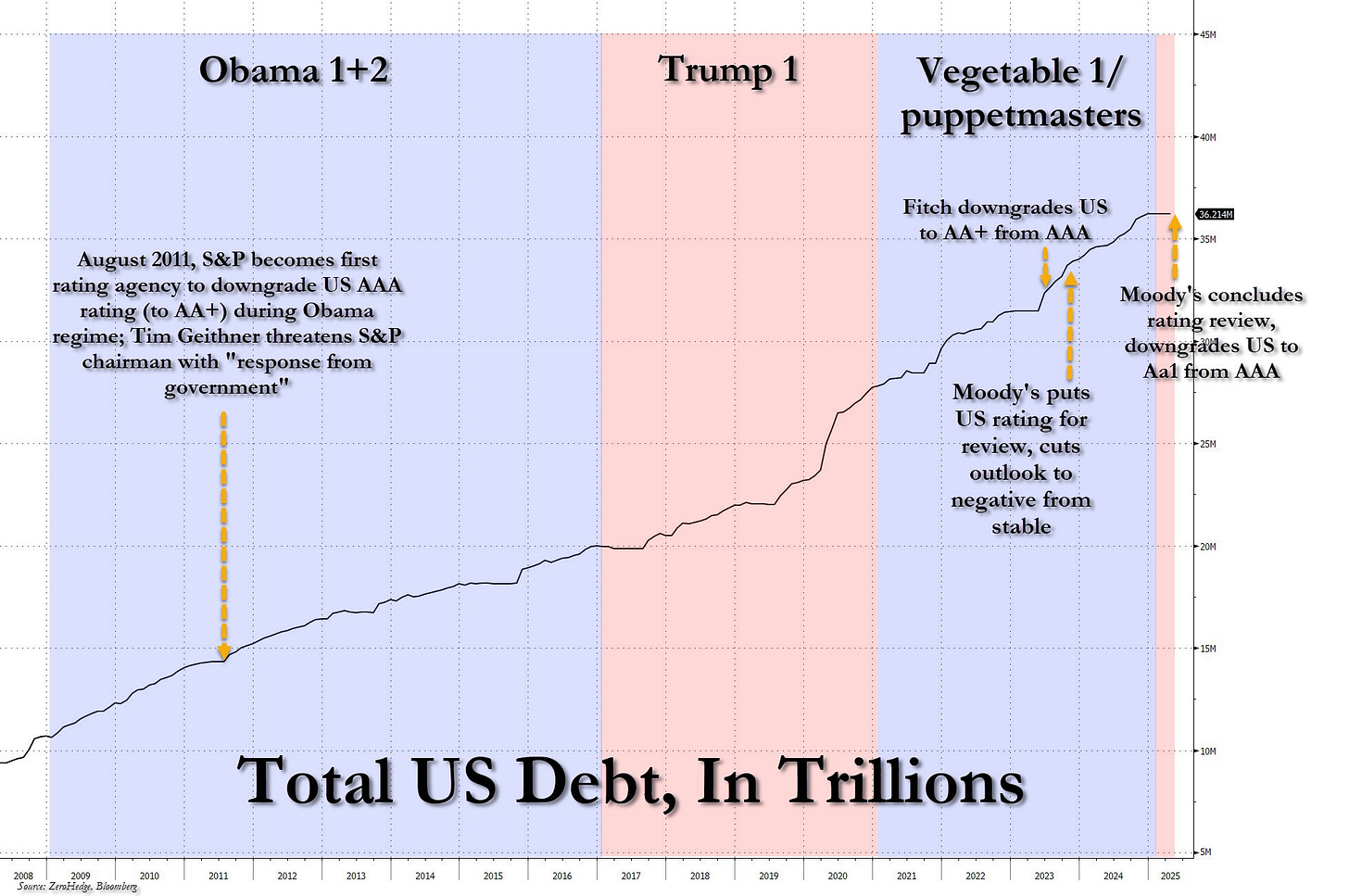

On Friday, the U.S. lost its last perfect credit rating as Moody’s downgraded it from ‘AAA’ to ‘Aa1,’ citing decades of rising deficits and interest costs. This ends a perfect rating streak held since 1917. Moody’s had warned in 2023 that a downgrade was possible, following similar moves by Fitch in 2023 and S&P in 2011.

The layers of irony behind this downgrade—and its timing—aren’t lost on me.

It’s a farce, really. By the logic Moody’s is now applying, the downgrade should have happened a decade ago, when it became painfully clear that the U.S. had a crippling spending addiction, compounded by a monetary ideology that essentially tried to reverse the fundamental laws of debits and credits.

Yes, it’s bad enough that the U.S. now carries $37 trillion in debt. But what’s worse is that, despite this massive burden, deficits have continued to grow—clear proof that we’ve learned nothing about fiscal restraint. Our refusal to stop putting everything on the national credit card, and our complete disregard for basic math and economic reality, should have triggered multiple downgrades over the past decade.

But the real kicker isn’t just the reckless spending—it’s our full embrace of Modern Monetary Theory, which doesn’t just ignore this irresponsibility but actively encourages it. Yet, somehow, Moody’s didn’t see a problem with monetary policy anytime before Friday.

To quote Peter Gibbons in Office Space:

“It’s not that I’m lazy, it’s that I just don’t care.”

Every time Paul Krugman wrote another column or Stephanie Kelton published a new book—and then got a national media platform to promote it—the U.S. deserved a downgrade.

Every time the Federal Reserve and the people responsible for advocating asinine monetary theory put on full display their inability to understand the economy or forecast economic events, it should have sent a message to rating agencies that the country is flying blind when it comes to fiscal and monetary policy, and that we deserved a downgrade.

When Ben Bernanke publicly said things like “we can print money at no cost,” the country should have been downgraded.

When Bernanke said the subprime crisis was “contained”, before it caused the collapse of the entire global economy, we should have been downgraded.

Every time a Fed governor like Neel Kashkari went on national television to declare that the Federal Reserve had “infinite money,” we should have been downgraded.

When Janet Yellen kept interest rates at 0% for years despite a roaring U.S. economy that was clearly no longer in need of unlimited stimulus, the country should have been downgraded.

And every time an analyst, famous investor, government official, or Fed member incorrectly claimed that inflation was transitory when it wasn’t, the country should have been downgraded.

No, it wasn’t just the backwards monetary policy we embraced to make ourselves feel better about our financial irresponsibility that should have led to downgrades; it was also the ongoing parade of public gaffes and humiliations by everyone associated with the Treasury Department and the Federal Reserve over the last two decades.

This put on full display to everyone in the world who was paying attention—apparently except the rating agencies—that we were on a treacherous path, destined to end in a catch-22.

Moody’s analyst

I used to write often not just about the Biden administration’s fiscal irresponsibility, but also about the fact that they didn’t even pretend to care about financial responsibility.

The Biden administration never even talked about the idea of making cuts or balancing the budget—the bare minimum any administration can do. Simply talking about fiscal discipline is often enough politically; you don’t even have to deliver results. But the Biden administration couldn’t even manage that.

And then along comes the Trump administration, running on the idea of trying to rein in spending and taking on the Herculean task of, at least in some small way, addressing the nation’s out-of-control deficit. There’s been talk about recalibrating global trade. There have been attempts—however slow—to curb spending through DOGE’s effort. And there’s been a focus on getting the country’s financial house and deficit back in order for the first time in at least a decade.

Only now, as the torch passes to the administration which, at the very least, is at least talking about balancing the budget and taking some steps toward it—Moody’s shows up and casually downgrades the country’s credit rating. Here’s the timing of the downgrade on a chart, in a way that only Zero Hedge can do:

Honestly, I don’t know whether to laugh at the fact that this didn’t happen a decade ago or at the fact that they waited until now—when balancing the budget is finally part of the national conversation—to do it. Either way, the downgrade is as hollow and performative as politicians jawboning about fiscal responsibility with no real intention of acting on it.

I’m not saying Moody’s was wrong, I’m saying it doesn’t matter. The U.S. has already set its course. One way or another, we’ll keep printing more money and relying on the dollar’s status as the global reserve currency to futilely prop up our standard of living.

There might be some adjustments in trade policy or spending, but our general trajectory was set after 2000, locked in after 2008, and supercharged by the unprecedented quantitative easing during COVID, when we simply papered over the entire economy with new cash, only to be befuddled by where excess inflation came from. Make no mistake: any time there’s financial instability going forward, the U.S. will print money first and ask questions later. And whatever Moody’s or any other rating agency has to say about it is irrelevant.

Long ago, we embarked on an unprecedented monetary policy experiment. And the outcomes will be just as unprecedented. That means neither you, nor I, nor the same rating agencies that were all but complicit in the subprime housing crisis, can predict how this ends.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

__________

Header featured image (edited) credit: YouTube grab public card. Emphasis added by (TLB)

••••

••••

Stay tuned…

![]()

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Leave a Reply