Mr. Trump Attacks Aluminum, Russia Attacks the Debt

by TOM LUONGO

Looking at the unfolding trade war between Donald Trump and the world the phrase that should come to mind is “One good turn deserves another.”

In the case of the insane sanctions on Oleg Deripaska and Russian Aluminum giant, Rusal, back in April, we finally got some clarity as to how Russia can and will respond to future events.

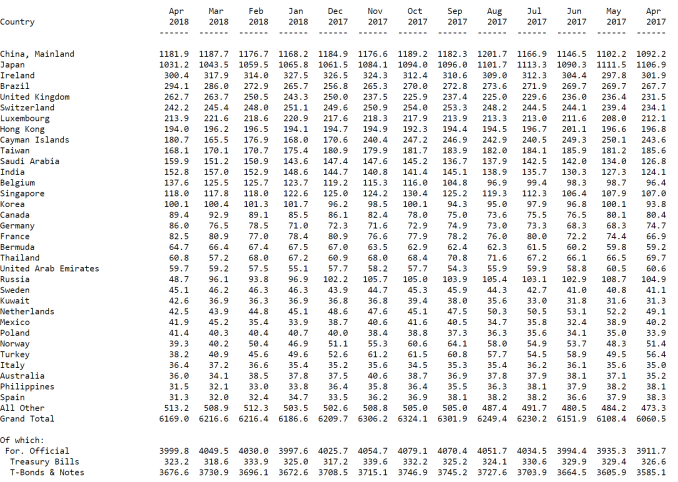

In yesterday’s Treasury International Capital (TIC) report, we saw clearly that Russia activated its nearly half of its $100 billion in U.S. Treasury debt to buy dollars in April. More than $47 billion in U.S. debt was dumped into the market to cover the chaos engendered by Trump’s overnight diktat for the world to stop doing business with Rusal.

Also of note, U.S. ally Japan continues to shed Treasuries at around 8-10 billion per month. Ireland dumped $17 billion and Luxembourg nearly $8 billion.

While China dropped $5 billion this is noise, ultimately as its holdings of U.S. debt have been stable for over a year now. What is interesting is Belgium, the home of Euroclear, seeing a $12 billion inflow. Likely that’s where some of the Russian-held debt was traded to.

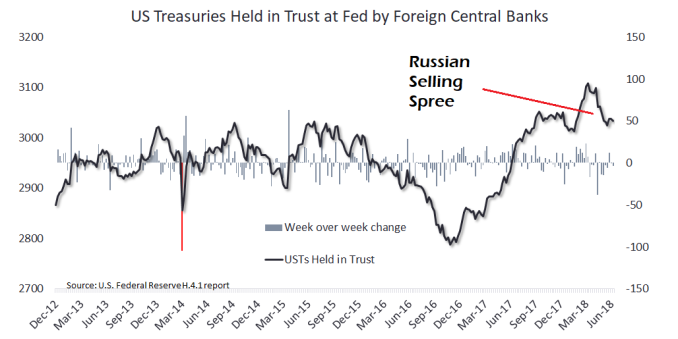

The Russians likely sold from their balance on reserve with the Federal Reserve. Here’s the latest iteration of the chart I keep for just such an occassion.

Rusal’s shares and bonds went bidless but the damage wasn’t contained there as major Russian banks like VTB and Sberbank were hit hard as well. So, while Rusal didn’t have much in the way of dollar-denominated debt. It did have major dollar-related obligations as accounts receivable on its balance sheet because of the sheer size of its trade conducted in dollars.

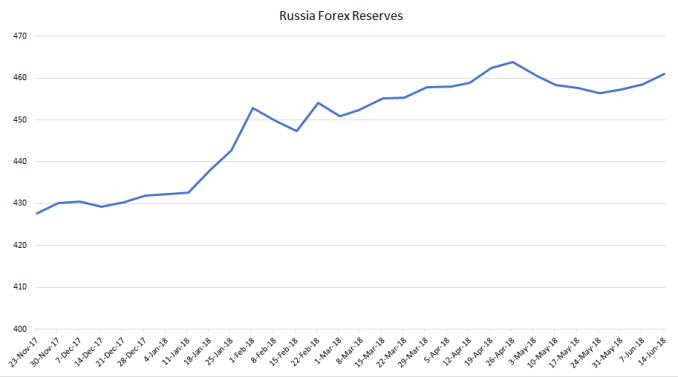

And that’s why there was such an outflow from Russia’s stock of Treasuries. But, here’s the thing. It didn’t matter one whit. Why? It didn’t undermine Russia’s Foreign Exchange Reserves.

No Dip in Russia’s Foreign Exchange Reserves During Rusal Crisis

Russia just sold Treasuries into the market, raised dollars and swapped out Rusal’s bonds, holding them as collateral for a Repo.

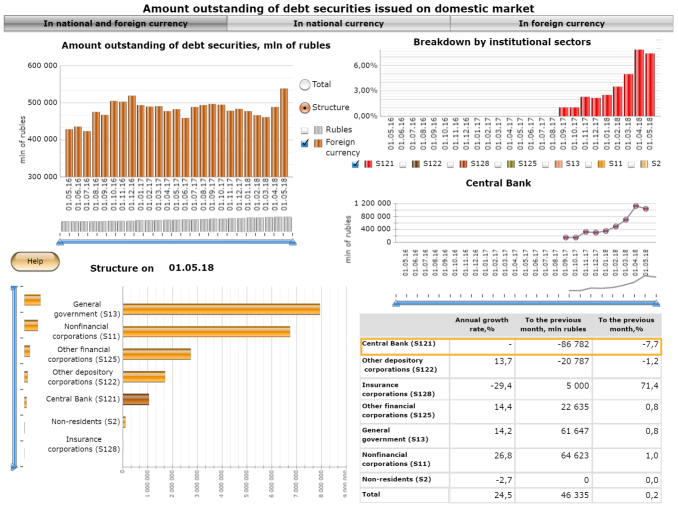

The Bank of Russia Intervened to keep Rusal and Other Banks Solvent by Dumping U.S. Treasuries

This went on for most of the month and into May. Zerohedge’s reporting on this leads the way.

This mass dumping of U.S. debt caused the long end of the U.S. yield curve to blow out past significant resistance points, like the 10 year pushing above 3.05% in sympathy with the Fed’s policy to dry up dollar liquidity. If this first-order analysis by Zerohedge is correct, then we can assume Russia has been holding a lot of long-dated Treasuries versus say China which we know has shortened up the average maturity of their massive bond portfolio.

In times past we may have not seen such a massive dump of U.S. debt by Russia. They may have simply sold dollars directly or swapped euros or yuan for them. But, these are different times. Trump has taken the use of sanctions to a level that hasn’t been seen before.

Putin is the master of parallel aggression. You take an action against Russia, he will generally hit you back along some other vector.

In this case it was a direct confrontation to Trump’s bringing the full weight of U.S. financial dominance down on its rivals and allies, who are all heavily exposed to Rusal’s market position.

Russia is not out of the water with this situation which is why Oleg Deripaska, the majority owner of Rusal and the one targeted by the Trump administration, is looking still to find ways to satisfy the U.S.’s demands on this issue.

Putin’s Pivot

But, don’t think this isn’t working to Putin’s advantage as Deripaska is not one of his supposed favored oligarchs. This report from Bloomberg spelled out the situation well back in April.

As for Deripaska, he will get help from the Russian government again. {which he did, see above} Rusal has warned that the sanctions might mean a default on a portion of its debt. That’s most likely to happen to its more than $1 billion in dollar-denominated debt. But, as ever, the company’s biggest creditors are Russian state banks, and the Kremlin will keep Rusal solvent one way or another as it reorients toward Asian markets. It won’t be a huge headache for Putin: He’s seen worse, including with Rusal during the financial crisis.

And that’s the most important part.

Once the current positions are wound down and the aluminum market adjusts to the new reality of U.S. hyper-aggression to restart an industry we really don’t need (smelting aluminum? really?) just to satisfy Trump’s outdated views on trade (which they are MAGA-pedes) Rusal’s business will not be so U.S.-centric.

And therefore the world will become less exposed, over time, to the depredations of U.S. financial attack. I told you before that China has responded to this by issuing new yuan-denominated futures contracts for industrial metals.

Why do you think they did that?

Will it create pain in the short-term? Yes. Europe will experience even more of this as will Asia.

Will a lot of companies fear being sanctioned and fined by the U.S. for doing business with Rusal? Yes. It’s happening now. Will this exacerbate underlying economic conditions in Europe? Of course.

But, if Deripaska submits, like it looks like he will, then the aluminum market will calm down and Trump’s sanctions will look silly.

Sanctions Bite Both Ways

The net result will be more of the aluminum market will flow through the Yuan rather than the dollar, neatly avoiding sanctions and any future threats. Because with the insanity caused by the overnight chaos in April, any aluminum supplier/consumer will be wary of another such edict from the naked Emperor in D.C.

And, as such, they will diversify the currencies they buy and sell aluminum in. It won’t be a sea change overnight. Those least exposed will jump ship first. Rusal will be one of the main beneficiaries since Russian banks are already sanctioned.

But it will be a trend, that once started will gain steam.

China can and will tie convertibility of its futures contracts to gold through the Shanghai exchange to allay worries about getting money out of the country.

Abusing your customers is never a winning marketplace strategy and that’s exactly what Trump’s sanctions policy is doing, abusing customers of the dollar. Trust has been the dollar’s strongest attribute for a long time now and it is the primary reason why it has dominated trade and reserves.

But there is a limit to how much your customers will take. And Trump is pushing well beyond that limit. And when the benefits of using the dollar are eclipsed by the liabilities, people will naturally shift away from it.

Look at the TIC chart above and note the total. This is a $6.3 trillion synthetic short position against the dollar. He’s inviting countries to dump treasuries to defend their currencies as the dollar strengthens while shifting their primary materials buying to the biggest rival’s currency.

This is why Russia continues to run a very tight financial ship while it leads the charge away from the dollar. It’s inviting customers into the ruble with both a strong national balance sheet and relatively higher interest rates. This has the U.S. fuming.

Putin has and will use future mini-crises like this to further clean up the rot left over from the Yeltsin years, like Deripaska, while building a Russia insulated from future attacks like this.

Remember, even the U.S. has limits. It cannot sanction people for refusing to trade in dollars. Even the U.S. doesn’t have that power. It can try but it will fail. New systems, new banks, new institutions can always be created.

*********

(TLB) published this article from Tom Luongo’s blog with our appreciation for the availability.

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our main websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … TLB

••••

Leave a Reply